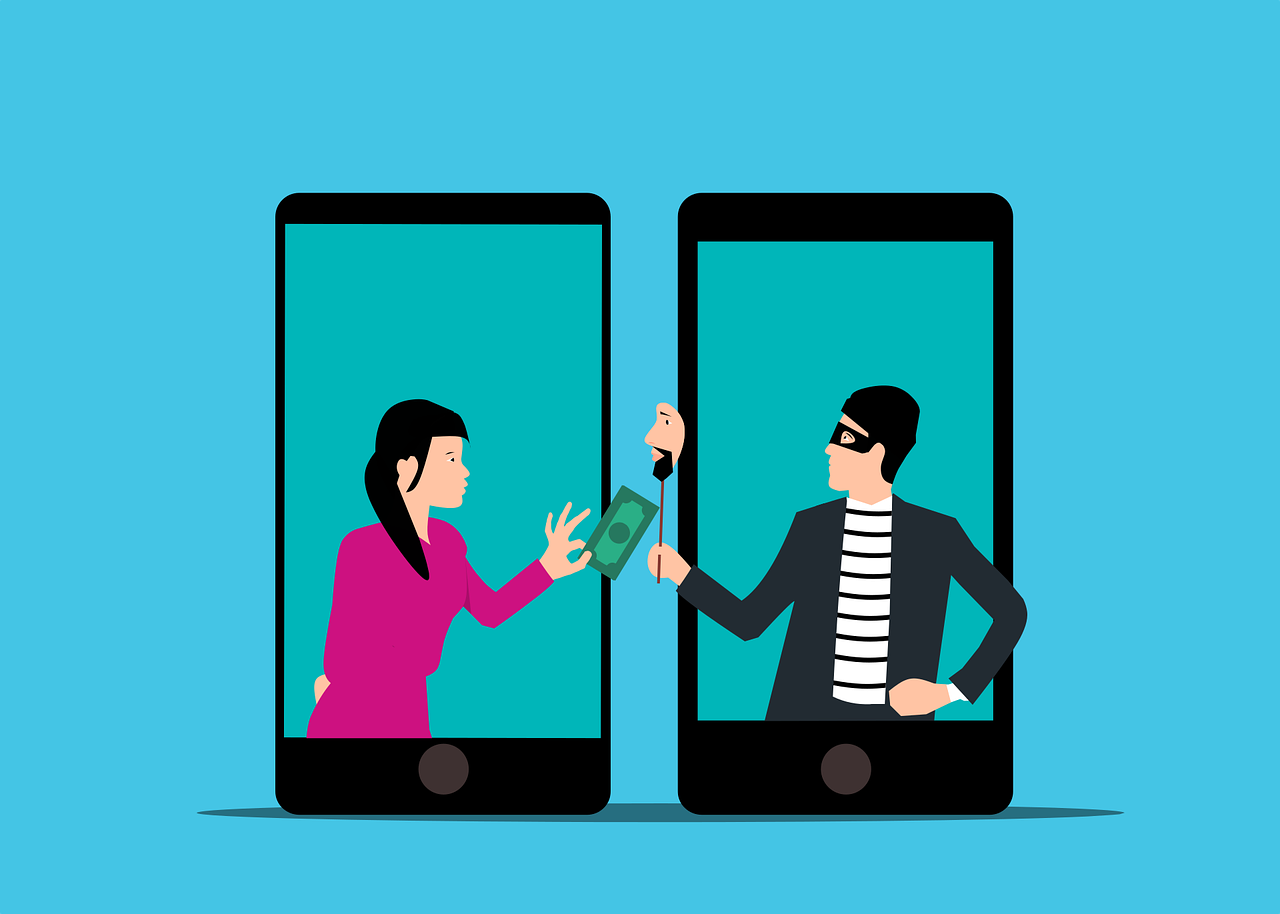

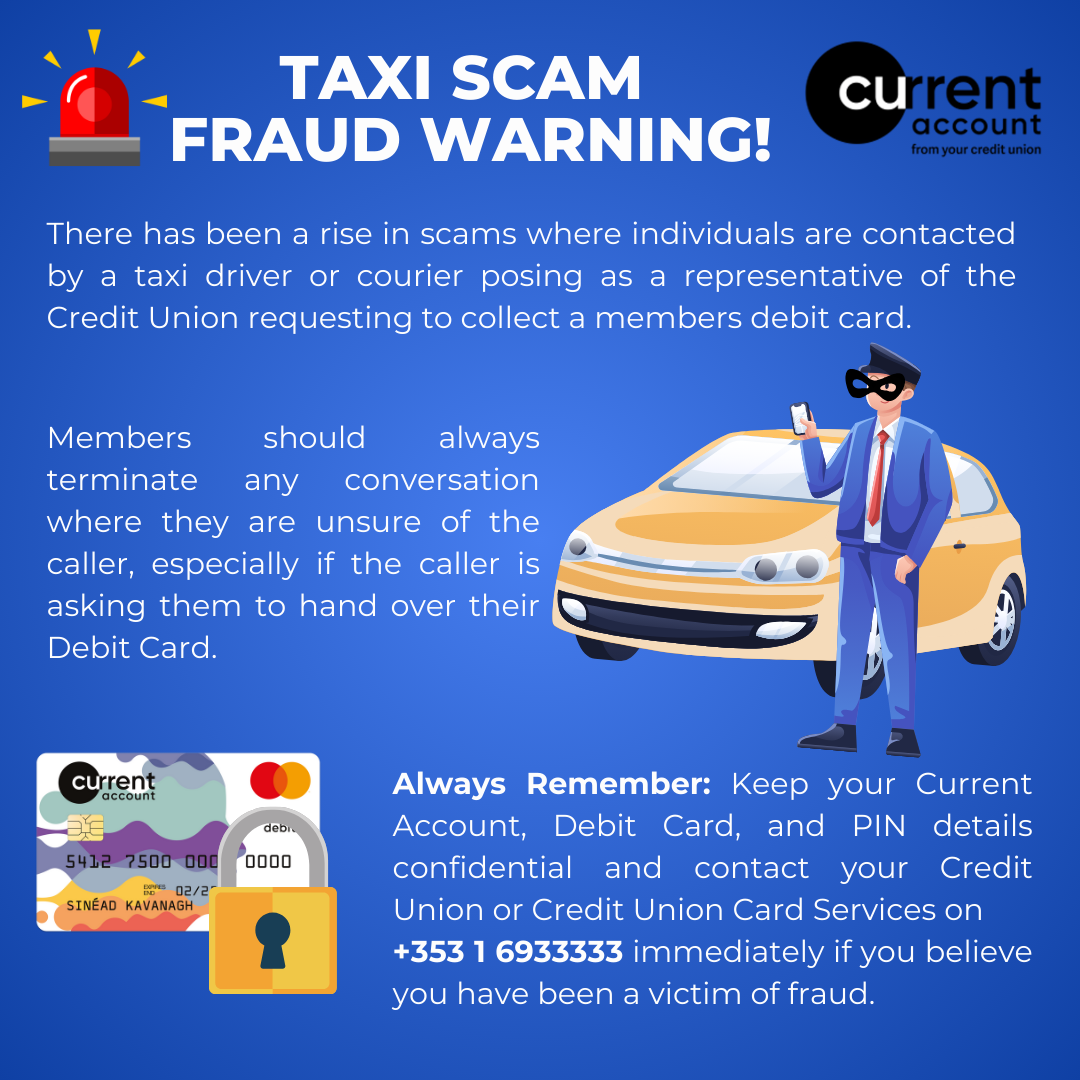

Fraudsters change their caller ID to disguise their identity from the person they are calling.

What to look out for:

- Where a card has been recently compromised through fraud, the fraudsters latch onto the victim, once they see a card has been blocked as a result of the fraud that they have committed then they call the victim and apply number spoof by changing their caller ID to match the genuine phone number of the real financial institution and luring the victim info a false sense of security by saying “the caller ID of this call is the same as the number on the back of bank card”

- The scam can span over several days. Posing as the bank, the fraudsters continually call the victim, building up a rapport, sourcing more and more information with each interaction and in the background, they are setting up fake profiles, applying for loans, overdrafts etc.

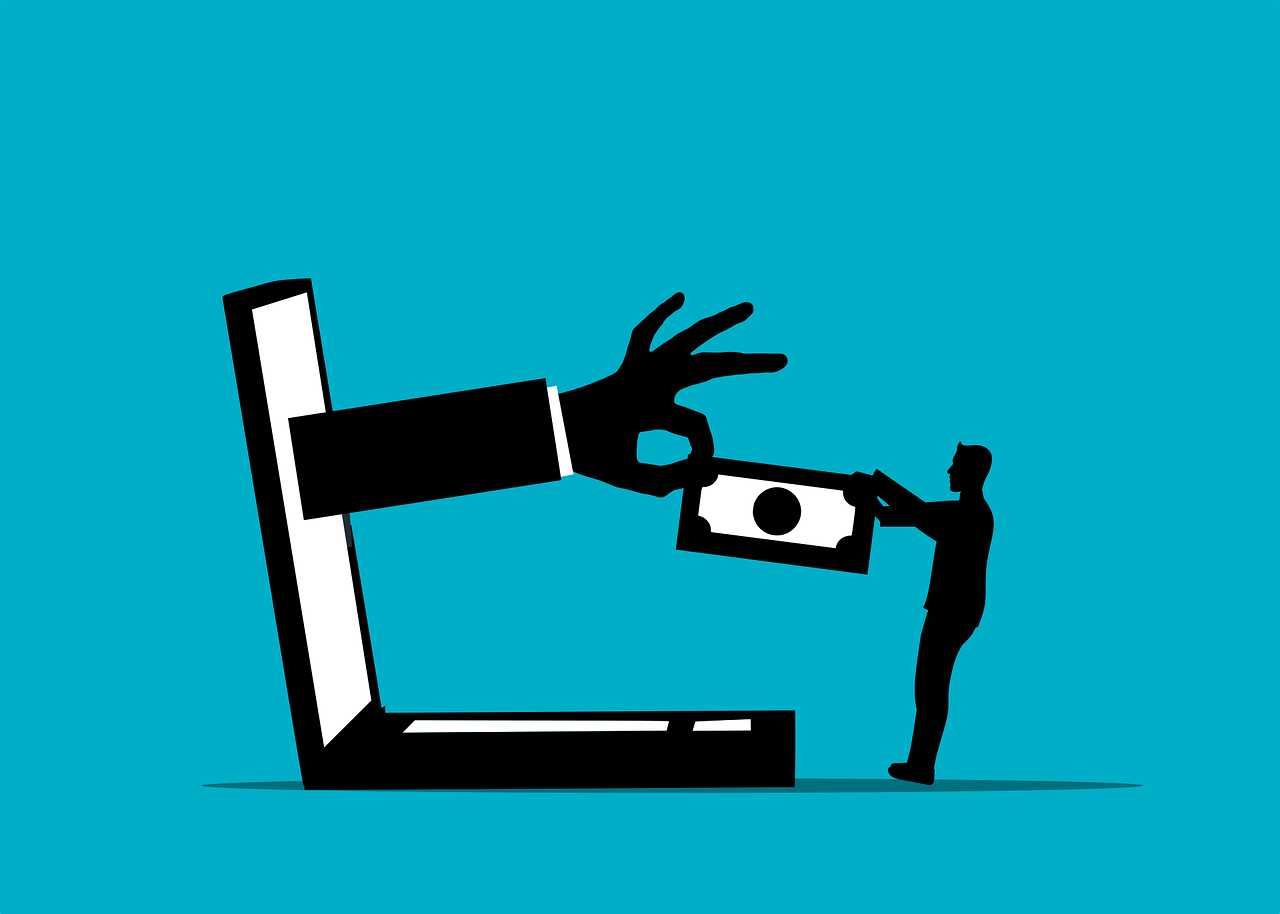

- Finally, they request the victim to open a new account and move all the money to the new account and they disappear with all the members funds from the new account.

- Fraudsters have many ways of using number spoofing to their advantage, the following is one such example. If in doubt call Credit Union Plus directly on 046 90 21395 or call into any of our branches to discuss your suspicions with an advisor.

How to safeguard yourself:

- Never move money for anyone, to anyone, and never if there is a sense of urgency.

- Turn off (power down) your phone before you ring to confirm if the call is genuine. Fraudsters can keep the phone connection open after a call has connected and when the member thinks they have hung up to dial the number back, the fraudsters can stay connected and reconnect the call again to keep the ruse in play